We Use Cookies

FinLego uses cookies to enhance your browsing experience, analyze site traffic, and personalize content. Please accept to continue using our site. Learn more about our Cookie Policy.

FinLego uses cookies to enhance your browsing experience, analyze site traffic, and personalize content. Please accept to continue using our site. Learn more about our Cookie Policy.

Launch your | in weeks, not months

Modular. Integrated. Compliant.

Modular. Integrated. Compliant.

We know what matters

-

Speed to MarketDeploy your full-stack fintech solution in a few weeks - 10× faster compared with building in-house.

Speed to MarketDeploy your full-stack fintech solution in a few weeks - 10× faster compared with building in-house. -

Cost EfficientAvoid $1–2M in up-front development costs. FinLego offers a transparent monthly subscription model.

Cost EfficientAvoid $1–2M in up-front development costs. FinLego offers a transparent monthly subscription model. -

Fiat & Crypto in One PlatformOur infrastructure is uniquely built to support both traditional banking and digital assets - natively.

Fiat & Crypto in One PlatformOur infrastructure is uniquely built to support both traditional banking and digital assets - natively. -

Flexible & ModularPick only the building blocks you need. Use our white-label UI or build your own on top of our APIs.

Flexible & ModularPick only the building blocks you need. Use our white-label UI or build your own on top of our APIs. -

Compliance ReadinessPre‑certified compliance modules (KYC, AML, reporting) to keep you audit‑ready from day one.

Compliance ReadinessPre‑certified compliance modules (KYC, AML, reporting) to keep you audit‑ready from day one. -

Regulatory ReadinessMeeting all essential regulatory requirements for modular core banking and crypto platforms.

Regulatory ReadinessMeeting all essential regulatory requirements for modular core banking and crypto platforms.

FinLego powers innovators

Fintech

Fintech

Crypto

Why build from scratch when you can launch in weeks?

Compare the traditional in-house development path with FinLego’s pre-built, scalable infrastructure - and see how much time, cost, and risk you can save.

FinLego Platform

Weeks

<$50k

Out‑of‑the‑box, ISO-certified

Automated updates, 24/7 support

30+ pre‑integrated partners

Auto‑scaling cloud infrastructure

<$50k

Out‑of‑the‑box, ISO-certified

Automated updates, 24/7 support

30+ pre‑integrated partners

Auto‑scaling cloud infrastructure

In‑House Development

6–12 months

$500k+

Custom build & audit

Dedicated team, ongoing headcount

Identify & onboard yourself

Team expansion required

$500k+

Custom build & audit

Dedicated team, ongoing headcount

Identify & onboard yourself

Team expansion required

Feature

Time to MVP

Up‑front Investment

Regulatory Module

Maintenance & Upgrades

Integration Partners

Time to Scale

Up‑front Investment

Regulatory Module

Maintenance & Upgrades

Integration Partners

Time to Scale

FinLego Platform

Auto‑scaling cloud infrastructure

Time to Scale

30+ pre‑integrated partners

Integration Partners

Automated updates, 24/7 support

Maintenance & Upgrades

Out‑of‑the‑box, ISO-certified

Regulatory Module

Weeks

Time to MVP

<$50k

Up‑front Investment

In‑House Development

Team expansion required

Time to Scale

Identify & onboard yourself

Integration Partners

Dedicated team, ongoing headcount

Maintenance & Upgrades

Custom build & audit

Regulatory Module

6–12 months

Time to MVP

$500k+

Up‑front Investment

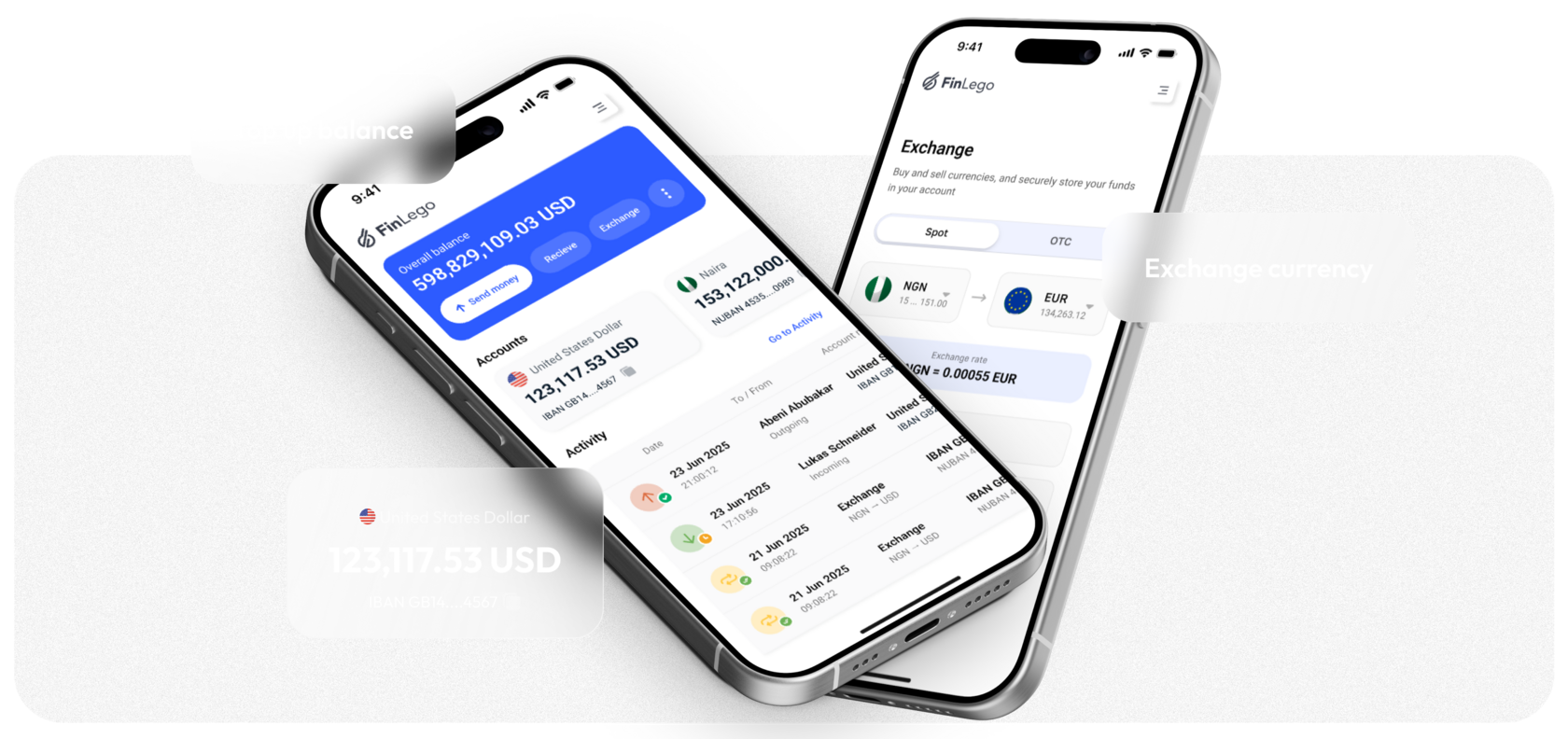

Flexible modules to customize your banking ecosystem

A modular and scalable foundation designed to manage accounts, transactions, interest, and financial workflows with precision. Our core banking engine supports multi-currency operations, real-time processing, and ensures the performance and stability for modern financial institutions.

Launch branded, secure digital wallets with multi-currency support, instant transfers, and integrated onboarding. Enable your users to send, receive, hold, and convert funds - all through APIs or white-label interfaces, ready to scale globally.

A robust, double-entry accounting engine built for regulatory-grade transparency and accuracy. The ledger system ensures every transaction is traceable, auditable, and compliant, giving your business a clear financial trail across all accounts and services.

Issue and manage virtual or physical cards effortlessly. Our platform supports full lifecycle control - design, activation, tokenization, and spending rules - integrated with card networks and processors to give your users a seamless payment experience.

Enable crypto-native capabilities with institutional-grade payment flows. Accept and process cryptocurrencies, settle instantly, and connect to fiat gateways. Ideal for fintechs bridging traditional and digital finance.

Offer secure multi-asset crypto wallets with real-time balance tracking, transaction histories, and cold/hot wallet configurations. Built with compliance and user security in mind, our crypto infrastructure supports scalability and regulatory needs from day one.

Accelerate your mobile banking experience with fully branded, ready-to-launch apps for iOS and Android. Intuitive, secure, and customizable, these apps enable account access, fund transfers, card control, and notifications - anytime, anywhere.

Stay ahead of compliance with pre-integrated identity verification, transaction monitoring, and rule-based alerts. Our KYC/AML toolkit helps you meet global regulatory standards while reducing fraud risk and streamlining onboarding.

Launch faster with a turnkey digital banking front end. Our white-label banking gives you a modern, cloud-based portal for both retail and business users - customizable to your brand, integrated with backend systems, and ready to go live in weeks, not months.

Trusted by innovators. Proven by results.

- Case Study: Neobank Reinvents Customer ExperienceModules:

Core Banking System, Mobile Apps, Cards Issuing, KYC/AML Tools

Outcome:- 40% faster onboarding,

- 99.9% uptime,

- Zero compliance issues;

- Net Promoter Score +25.

- Case Study: Crypto Bank Optimizes

OperationsModules:

Core Banking System, Crypto Wallets, Crypto Payments, KYC/AML Tools

Outcome:- 60% reduction in operational costs

- Real-time multi-asset processing

- Improved risk controls and regulatory alignment.

- Case Study: Digital Wallet Expands Across MarketsModules:

Wallet-as-a-Service, Mobile Apps, Ledger, White Label Bank

Outcome:- Scaled to 6 new markets

- 3× transaction volume in 6 months

- Seamless brand deployment across platforms.

- Case Study: Fintech Startup Accelerates Time to MarketModules:

Core Banking System, Ledger, KYC/AML Tools, White Label Bank

Outcome:- Launched MVP in under 2 months

- Reduced development costs by 45%

- Achieved compliance-readiness on day one.

Enterprise-grade protection.

Built-in compliance.

Ready for global scale.

Built-in compliance.

Ready for global scale.

-

Banking-grade encryptionfor data at rest and in transit

Banking-grade encryptionfor data at rest and in transit -

Automated KYC/AML toolsaligned with global standards

Automated KYC/AML toolsaligned with global standards -

Real-time fraud detectionand transaction monitoring

Real-time fraud detectionand transaction monitoring -

Certified infrastructureISO 27001, GDPR-ready

Certified infrastructureISO 27001, GDPR-ready

You are just a few steps away

from launching your financial product!

from launching your financial product!

Select Your Modules

Pick only the building blocks you need - no up‑front bloat.

We Assemble Your Solution

Our expert team spins up your environment, integrations, and sandbox.

Customize & Brand

We tailor UI/UX, workflows, rules and brand guidelines for your company.

Load Your Data

Migrate customers, balances, transaction history - securely and seamlessly.

Go Live

Launch to production in a few weeks with 99.99% SLA support.

Frequently Asked Questions

From contract to go‑live in as little as several weeks, depending on scope.

FinLego supports financial product launches in all major regulatory jurisdictions worldwide. Through our network of licensed banking and compliance partners, we help you operate across the EU, UK, LATAM, MENA, Africa, and Asia-Pacific - without needing your own licence.

All data is encrypted at rest & in transit. We hold the ISO 27001 certification.

Yes. Add or swap modules via our Admin Dashboard without downtime.

24/7 enterprise‑grade support, dedicated success manager, and quarterly strategic reviews.

Yes. FinLego is containerized, API-first, and deployable across AWS regions. It’s trusted by high-volume fintechs and crypto platforms globally.

Your FinTech Launch Starts Now

The faster path to building a trusted financial product is here. FinLego helps you cut months of development, reduce cost, and go live with confidence - without compromising on performance or compliance.